Unknown Facts About Simply Solar Illinois

Unknown Facts About Simply Solar Illinois

Blog Article

More About Simply Solar Illinois

Table of ContentsAn Unbiased View of Simply Solar IllinoisSome Known Incorrect Statements About Simply Solar Illinois The Buzz on Simply Solar IllinoisExamine This Report about Simply Solar IllinoisWhat Does Simply Solar Illinois Do?

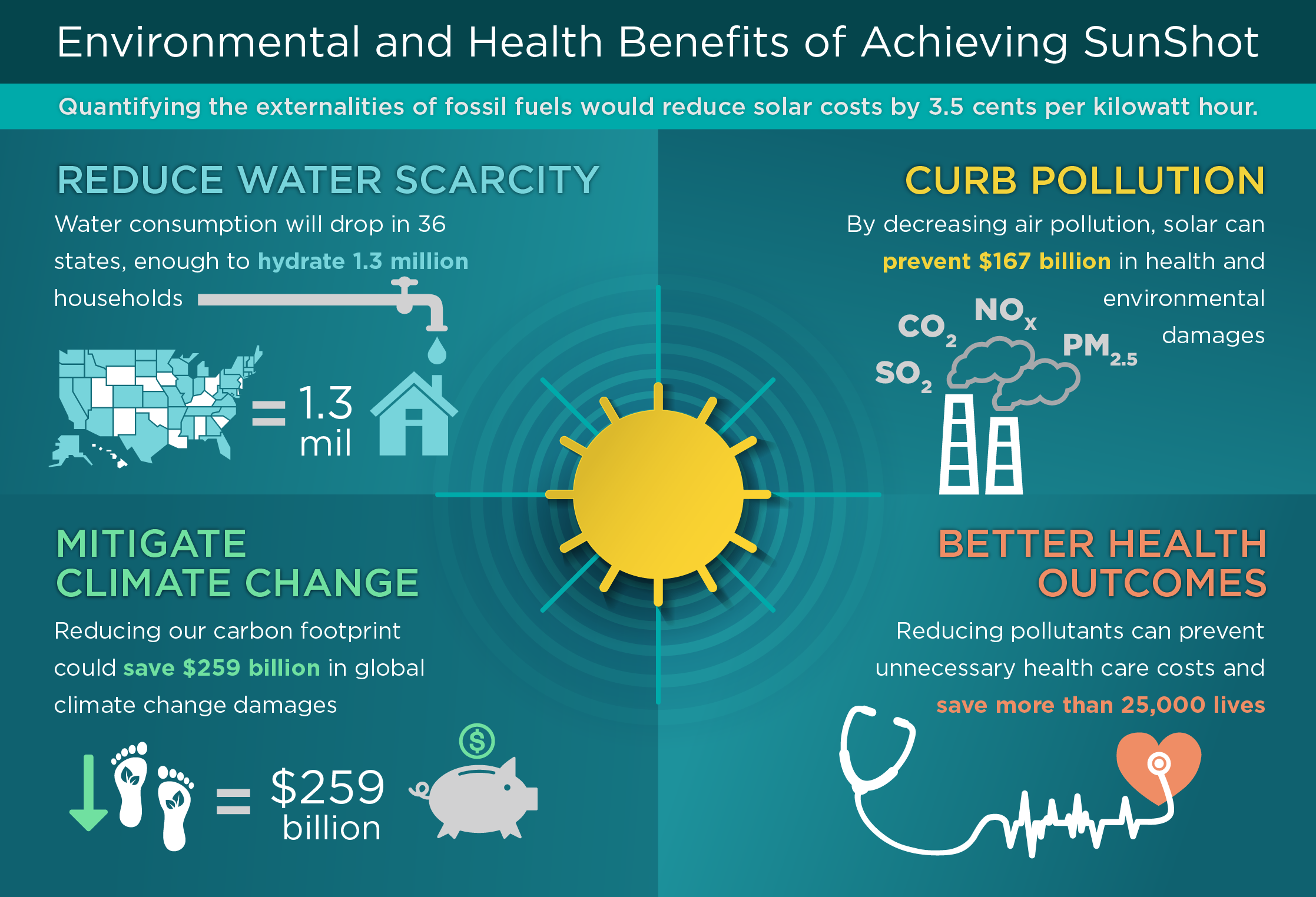

Our group partners with neighborhood neighborhoods throughout the Northeast and beyond to provide tidy, inexpensive and dependable power to cultivate healthy areas and keep the lights on. A solar or storage space project delivers a variety of advantages to the neighborhood it offers. As technology advancements and the price of solar and storage decrease, the economic advantages of going solar continue to increase.Assistance for pollinator-friendly habitat Habitat remediation on infected sites like brownfields and land fills Much needed shade for animals like sheep and fowl "Land banking" for future farming use and dirt high quality improvements As a result of climate adjustment, extreme weather condition is ending up being more constant and disruptive. Because of this, homeowners, services, communities, and energies are all becoming a growing number of curious about securing energy supply solutions that use resiliency and energy safety and security.

Ecological sustainability is another vital vehicle driver for organizations purchasing solar power. Numerous firms have robust sustainability goals that consist of minimizing greenhouse gas emissions and utilizing less sources to aid minimize their effect on the natural surroundings. There is an expanding urgency to resolve environment change and the pressure from customers, is arriving degrees of organizations.

The 7-Second Trick For Simply Solar Illinois

As we approach 2025, the combination of photovoltaic panels in commercial tasks is no much longer just an alternative but a critical requirement. This blogpost dives right into how solar power works and the diverse advantages it brings to commercial structures. Photovoltaic panel have actually been utilized on property structures for lots of years, however it's just lately that they're ending up being more common in industrial building and construction.

In this write-up we talk about just how solar panels job and the benefits of making use of solar power in business buildings. Electrical power expenses in the U.S. are increasing, making it extra pricey for organizations to operate and more tough to prepare ahead.

The United State Energy Information Management expects electric generation from solar to be the leading resource of growth in the united state power sector via the end of 2025, with 79 GW of new solar ability forecasted ahead online over the next two years. In the EIA's Short-Term Power Outlook, the agency claimed it expects renewable energy's general share of power generation to rise to 26% by the end of 2025

The Simply Solar Illinois Diaries

The photovoltaic solar cell soaks up solar radiation. The wires feed this DC power into the solar inverter and transform it to alternating power (A/C).

There are numerous ways to save solar power: When solar power is fed into an electrochemical battery, the chemical reaction on the battery parts maintains the solar power. In a reverse response, the existing departures from the battery storage for consumption. Thermal storage uses tools such as liquified salt or water to retain and soak up the warmth from the sunlight.

This system shops compressed air in big vessels such as containers or natural formations (e.g., caves), then launches the air to produce electrical power. Power is one of the greatest continuous costs that commercial buildings have. Solar panels significantly lower power prices. While the initial investment can be high, important link overtime the expense of mounting photovoltaic panels is recovered by the money saved on power expenses.

Simply Solar Illinois - The Facts

By mounting solar panels, a brand shows that it appreciates the environment and is making an effort to lower its carbon impact. Buildings that rely totally on electrical grids are vulnerable to power blackouts that take place during poor climate or electric system malfunctions. Photovoltaic panel mounted with battery systems allow industrial structures to proceed to operate throughout power blackouts.

Simply Solar Illinois Can Be Fun For Everyone

Solar energy is just one of the cleanest kinds of energy. With resilient service warranties and a manufacturing life of up to 40-50 years, solar financial investments add considerably to ecological sustainability. This change in the direction of cleaner energy sources can bring about wider financial advantages, you can find out more consisting of decreased climate modification and ecological deterioration costs. In 2024, home owners can gain from government solar tax obligation incentives, allowing them to offset nearly one-third of go right here the acquisition rate of a solar system through a 30% tax obligation credit.

Report this page